Ipsos Quarterly Digital Music Study TEMPO: Keeping Pace With Digital Music Behavior Finds That Over Half of American Teen And Adult Music Downloaders Have Paid

Study Also Finds College-Age Downloaders Still Reluctant To Pony Up

New York, NY — Following strong holiday season sales of portable MP3 players, heightened awareness of fee-based online music services and recent high-profile satellite radio content deals, American consumers continue to experiment with fee-based digital music services in record numbers, according to new findings from global marketing research firm Ipsos Insight.

Over Half of U.S. Downloaders Have Paid – One Quarter in the Past 30 Days

New findings from TEMPO, the Ipsos Insight quarterly study of digital music behaviors, reveal that in December of 2005, over half (52%) of American downloaders aged 12 and older report having paid a fee to download music or MP3 files from the Internet, and 24% had done so in the past 30 days. These figures represent a continued increase in fee-based downloading activity over the past year (47% reported having paid a fee to download music or MP3 files from the Internet in December 2004), and a six-fold jump since December 2002. Based on the current US Census figures, approximately 25 million people have paid a fee to download music or MP3 files from the Internet - 11 million Americans in the past 30 days.

Recent TEMPO research also revealed some interesting demographic and diagnostic trends surrounding the growth of fee-based digital music:

- Adult downloaders aged 25 to 54 continue to drive the growth in fee-based downloading (67% have ever paid to download among 25 to 34 year olds, 59% among 35 to 54 year olds). And while younger downloaders continue to experiment with fee-based downloading, they are less likely than older downloaders to have done so in the past 30 days. Furthermore, only 13% of college aged downloaders have paid for digital music in the past 30 days.

- Nearly equal proportions of male and female downloaders have paid to download digital music files off of the Internet: 51% of U.S. male downloaders aged 12 or older report having engaged in this activity compared to 53% of American females. American female downloaders are less likely to have paid to download in the past 30 days, however, with only 18% compared to 29% of males). This compares to December 2004 tracking data in which past 30 day fee-based downloading was 18% and 15%, respectively, and suggests that males are now driving repetitive fee-based download activity.

- U.S. fee-based downloaders in this evolving digital marketplace are nearly three times as likely to have used a la carte download (or ‘pay-as-you-go’) services compared to fee-based subscriptions, (77% vs. 27%), and when they do, they download an average of eight songs each month.

- Despite the current popularity of online a la carte services, when asked whether online fee-based a la carte, subscription, or satellite radio was the most appealing digital music service, U.S. downloaders (and particularly those aged 18-24 and 35 or older) were most likely to say Satellite Radio (32% vs. 28% for fee-based a la carte and 8% for fee-based online subscriptions services among total U.S. downloaders age 12 and older).

- One-fifth of Americans aged 12 and older now own a Portable MP3 Player, up from 12% in December of 2004.

“Over the past year, the digital music market has continued to evolve into a formidable music distribution channel marked by steady growth and increasingly dynamic usage levels. Americans are indeed curious about and willing to experiment with current fee-based acquisition options,” said Matt Kleinschmit, a Vice President with Ipsos Insight and author of the TEMPO research. “But for digital music service providers to continue to boost overall purchase patterns, they will have to work to continually refine and optimize their offer in an effort to encourage more repetitive consumer buying behavior – perhaps via additional service incentives, exclusive content offers or hybrid service options suited to the needs of specific digital music market segments.”

Desire For A La Carte Songs And Recent Portable Device Purchases Fuel Growth

The study found that for many frequent fee-based downloaders, the desire to purchase an individual song without having to buy the entire album fueled their first foray into fee-based digital music, with a recent portable MP3 player purchase and the perceived convenience of an online purchase also being key drivers to initial fee-based downloading. This is reinforced by the findings that 30% of US fee-based downloaders first paid to download within in the past 6 months, and corresponds with record growth over the past year in Portable MP3 Player ownership. One-fifth of Americans aged 12 and older now own a Portable MP3 Player, up from 12% in December of 2004. This boost was driven by increases across all age groups, with a significant boost among music downloaders (45%, up from 27% in December 2004).

“This suggests that many consumers may act impulsively when entering this market, with the moment of truth in fee-based digital music coming via the desire for an individual song, convenience and as a means of acquiring content for their new MP3 player,” said Kleinschmit. “This is significant given the growing popularity of portable devices and increasing availability of advanced digital music content options. The key for continued overall category growth will be to encourage consumers who are new to this market and sampling fee-based services for the first time to become more consistent in their fee-based content acquisition behaviors. Establishing habitual interaction with these services and content, particularly a la carte downloads, mobile ringtones, online subscription services and satellite radio, will be critical in expanding and sustaining these still developing and potentially lucrative music markets, and could well lead to broader ramifications in music production, recording, publishing and other associated industries.”

Charts:

http://www.ipsos-na.com/news/client/act_dsp_pdf.cfm?name=mr060223-1tb2.pdf&id=2984Methodology

Data on music downloading behaviors was gathered from TEMPO: Keeping Pace with Digital Music Behavior, a quarterly shared-cost research study by Ipsos Insight examining the ongoing influence and effects of digital music around the world.

Data for this release were collected between December 6 and 15, 2005, via a nationally representative U.S. sample of 1,108 respondents aged 12 and over. With a total sample size of 1,108, one can say with 95% certainty that the results are accurate to within +/- 2.94%.

Additional in-depth downloader data were collected between January 13 and 24, 2006, via a representative sample of 1,517 U.S. downloaders aged 12 and over. With a total sample size of 1,517, one can say with 95% certainty that the results are accurate to within +/- 2.52%.

To learn more about the methodology of TEMPO, please visit

www.ipsosinsight.com/tempo.cfmVisit

www.ipsos.com to learn more about Ipsos offerings and capabilities.

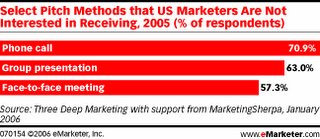

Today, most marketers prefer Web-based presentations and pitches. Links to a Web site and e-mail information were favored.

Today, most marketers prefer Web-based presentations and pitches. Links to a Web site and e-mail information were favored.